480 Toa Payoh Lorong 6 #10-01 HDB Hub East Wing Singapore 310480

Can HDB safeguard your retirement?

Today we will explore the HDB market and evaluate the feasibility of relying on your flat for retirement. With the consistent escalation of property prices, we have observed unprecedented transaction prices for HDB flats in recent years. Moreover, the lifestyle and aspirations of younger Singaporeans have undergone a significant transformation from their predecessors. As a result, a growing number of young HDB homeowners are aiming to upgrade to private properties. Is this something that resonates with you?

We acknowledge that this could be a daunting decision for some, especially if you are not well-versed in financial matters and do not possess comprehensive knowledge of the property market.

INVESTMENTS IN

PRIVATE HOMES

About

The illustrations provided offer a concise summary of the potential concerns associated with investing in private properties. These include apprehension towards managing substantial mortgage payments, shouldering additional expenses each month, and the persistent advice from older generations to view HDB flats as the safest initial investment and to work diligently towards a comfortable retirement.

Understandably, it may seem simpler to avoid this topic altogether and remain content residing in one’s present home. After all, ignorance is said to be bliss. While this is not necessarily an unwise or incorrect choice, it may not be the most optimal one for those seeking a better lifestyle or an earlier retirement.

By continuing to read this article, you can gain a better understanding of what may be most beneficial for you and your family. At the conclusion of this piece, you should have a clearer idea of the most advantageous course of action.

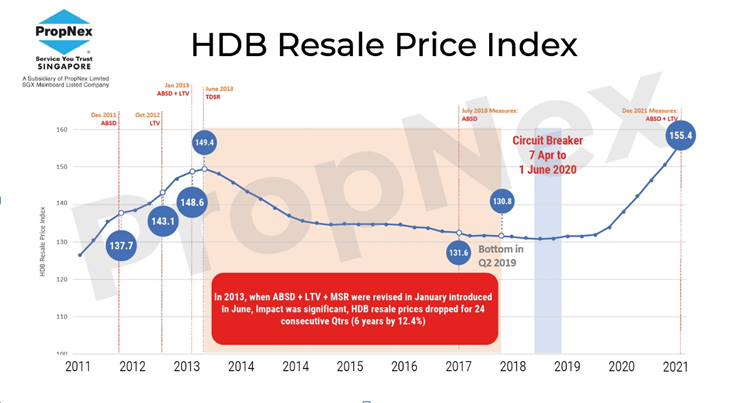

FIGURE 1

To begin, let us examine the HDB price movement chart (Figure 1) below, which depicts the quarterly resale price index over a ten-year period from 2011 to 2021. In 2013, the government implemented a cooling measure mandating that all HDB buyers’ loans be based on their Mortgage Servicing Ratio (MSR). This action had an impact on HDB prices, causing the market to decline for several years before rebounding in 2019. Many may wonder why the government chose to take such action. It was to prevent HDB resale prices from escalating and making the resale HDB market inaccessible to many young couples. Ultimately, it is crucial for our elected representatives in parliament to ensure that public housing remains affordable for generations to come.

While it took approximately eight years for the HDB resale market to reach its prior peak, there were numerous opportunities available to HDB owners during this period. In particular, those who opted to retain their flats since the previous peak in 2012/2013 have gone on to upgrade their properties to an Executive Condominium or even a private property, and as a result, have made significant capital gains. If you feel that you may have missed out on these opportunities, there is no need to worry; there are still many prospects available to you. However, how long this window of opportunity will last remains an open question. Nonetheless, it is important to seize this chance to learn more and avoid similar errors. Later in this article, we will explore several examples of individuals who took action and benefited from it.

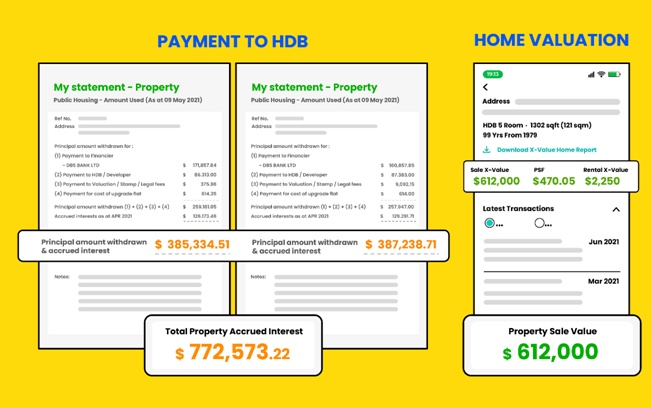

Introducing Figure 1, which shows the HDB resale price index over a 10-year period from 2011 to 2021. But before we delve into that, let’s explore the unfortunate situation of a hardworking couple who held onto their HDB flat for 30 years with hopes of appreciation, only to suffer a colossal loss of over $160,000.

As seen in the chart, the couple paid a total of over $700,000 for the flat, but it was only valued at around $612,000, resulting in a loss that was compounded by the accrued interest from CPF. This raises the question of whether the price of your flat can increase enough to cover the interest on your mortgage and CPF.

The traditional strategy of buying an HDB and staying put until retirement, as advised by parents, may no longer be effective. After seeing the example above, it is crucial to consider whether you want to risk suffering a similar loss at retirement age.

In the latter part of 2021, our government implemented additional cooling measures to put the brakes on the overheated property market. Despite the efforts to increase the supply and introduce Prime Location Public Housing for HDBs, the HDB market seems unaffected by the new measures. It remains uncertain whether these actions will eventually cause the HDB market to slow down, but one thing is for sure: the prices of HDB cannot continue to rise indefinitely.

As shown in Figure 1, HDB prices have reached a new peak, and this presents a dilemma for HDB owners. In light of this, what should they do?

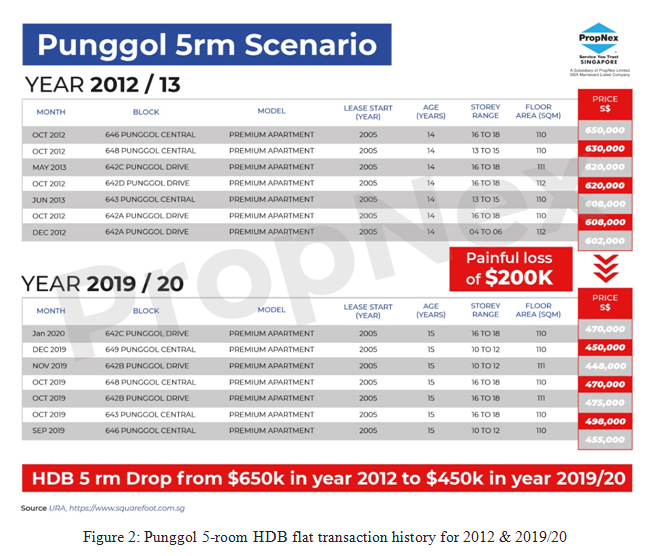

Figure 2 provides a stark comparison of the prices of a 5-bedroom flat in Punggol in 2012 and 2019/20, indicating a significant loss of $200,000 for those who held onto their flats. This situation could have been avoided with the right advice and timing.

If you had been a perceptive and well-informed property owner who sold their HDB at the right time and invested in a private property like Riversound condominium back in 2012, you could have easily reaped a massive profit averaging around $300,000, as indicated in Figure 3 below..